Taxnoun

Money paid to the government other than for transaction-specific goods and services.

Taxnoun

A burdensome demand.

Taxnoun

A task exacted from one who is under control; a contribution or service, the rendering of which is imposed upon a subject.

Taxnoun

(obsolete) charge; censure

Taxnoun

(obsolete) A lesson to be learned.

Taxverb

(transitive) To impose and collect a tax from (a person).

Taxverb

(transitive) To impose and collect a tax on (something).

Taxverb

(transitive) To make excessive demands on.

Taxnoun

A charge, especially a pecuniary burden which is imposed by authority.

Taxnoun

A charge or burden laid upon persons or property for the support of a government.

Taxnoun

A task exacted from one who is under control; a contribution or service, the rendering of which is imposed upon a subject.

Taxnoun

Especially, the sum laid upon specific things, as upon polls, lands, houses, income, etc.; as, a land tax; a window tax; a tax on carriages, and the like.

Taxnoun

A disagreeable or burdensome duty or charge; as, a heavy tax on time or health.

Taxnoun

A sum imposed or levied upon the members of a society to defray its expenses.

Taxnoun

Charge; censure.

Taxnoun

A lesson to be learned; a task.

Taxverb

To subject to the payment of a tax or taxes; to impose a tax upon; to lay a burden upon; especially, to exact money from for the support of government.

Taxverb

To assess, fix, or determine judicially, the amount of; as, to tax the cost of an action in court.

Taxverb

To charge; to accuse; also, to censure; - often followed by with, rarely by of before an indirect object; as, to tax a man with pride.

Taxnoun

charge against a citizen's person or property or activity for the support of government

Taxverb

levy a tax on;

Taxverb

set or determine the amount of (a payment such as a fine)

Taxverb

use to the limit;

Taxverb

make a charge against or accuse;

Taxnoun

a compulsory contribution to state revenue, levied by the government on workers' income and business profits, or added to the cost of some goods, services, and transactions

Taxnoun

a strain or heavy demand

Taxverb

impose a tax on (someone or something)

Taxverb

pay tax on (something, especially a vehicle)

Taxverb

make heavy demands on (someone's powers or resources)

Taxverb

confront (someone) with a fault or wrongdoing

Taxverb

examine and assess (the costs of a case)

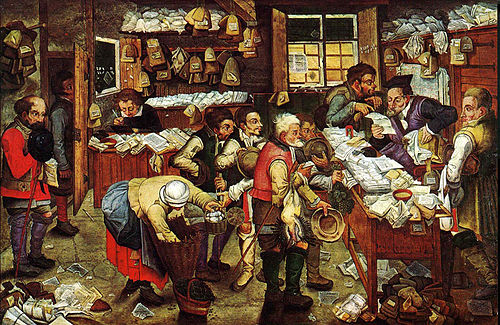

Tax

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures. A failure to pay, along with evasion of or resistance to taxation, is punishable by law.

Tariffnoun

A system of government-imposed duties levied on imported or exported goods; a list of such duties, or the duties themselves.

Tariffnoun

A schedule of rates, fees or prices.

Tariffnoun

(British) A sentence determined according to a scale of standard penalties for certain categories of crime.

Tariffverb

(transitive) to levy a duty on (something)

Tariffnoun

A schedule, system, or scheme of duties imposed by the government of a country upon goods imported or exported; as, a revenue tariff; a protective tariff; Clay's compromise tariff. (U. S. 1833).

Tariffnoun

The duty, or rate of duty, so imposed; as, the tariff on wool; a tariff of two cents a pound.

Tariffnoun

Any schedule or system of rates, changes, etc.; as, a tariff of fees, or of railroad fares.

Tariffverb

To make a list of duties on, as goods.

Tariffnoun

a government tax on imports or exports;

Tariffverb

charge a tariff;

Tariff

A tariff is a tax imposed by a government of a country or of a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry.